Friday, 6 March 2026

2024: A landmark year for alternative protein revolution

In 2024, the alternative protein industry underwent a transformative period marked by significant innovations, market expansions, and regulatory advancements, with an overall shift toward sustainability and consumer accessibility The year…

In 2024, the alternative protein industry underwent a transformative period marked by significant innovations, market expansions, and regulatory advancements, with an overall shift toward sustainability and consumer accessibility

The year 2024 marked a pivotal chapter for the alternative protein (alt-protein) industry, with breakthroughs and challenges shaping its landscape globally. From revolutionary product launches to policy milestones and innovative collaborations, the sector witnessed strides toward sustainability and consumer acceptance. Despite setbacks like regulatory hurdles and bans in select regions, the industry continued its relentless pursuit of transformative solutions for a sustainable future.

In 2024, the alternative protein industry underwent a transformative period marked by significant innovations, market expansions, and regulatory advancements, with an overall shift toward sustainability and consumer accessibility. Key trends and insights include:

Expansion of cultivated and plant-based proteins

Cultivated meat, particularly lab-grown beef and chicken, continued to make strides in production, with companies like Aleph Farms and Steakholder Foods gaining momentum. Aleph Farms’ foray into Thailand, a region with a significant appetite for meat alternatives, underscores the global market’s potential for cultivated proteins. Vow Foods also made headlines with the launch of cultivated foie gras, a breakthrough in high-end, sustainable meat alternatives, signalling growing consumer interest in premium, ethical food options.

The plant-based protein sector, driven by innovations like 3D-printed shrimp and eel from Steakholder Foods, reflects a significant push toward creating familiar, yet sustainable, animal-based alternatives. The focus on 3D printing technology advances the textures and flavours of plant-based proteins and opens new opportunities for creating highly customised food products that mirror their traditional counterparts.

Increased investments and funding

The year saw a surge in investments, with companies like Biokraft Foods securing funding to bring plant-based fat solutions to new markets and startups like Tender Food receiving financial support to scale their operations. Funding flowed into companies exploring innovative food solutions like Veeva’s expansion of plant-based beverages in China and Biokraft’s plant protein-based fat products aimed at replacing traditional animal fats. This influx of capital highlights growing investor confidence in the alternative protein sector and its potential to disrupt traditional meat production.

At the same time, high-profile acquisitions like the Vegan Food Group’s purchase of Magic Veg and Big Idea Ventures’ investment in various alternative protein startups signal an accelerated consolidation of the industry, as major players seek to expand their portfolios and reach new consumer segments.

Technological advancements and manufacturing innovations

Technologies aimed at improving the efficiency and scalability of alternative protein production played a central role in the industry’s growth. Ubiquity Sprouting Corporation’s new plant milk production equipment promises to revolutionise the germination process, improving both cost-effectiveness and sustainability. Similarly, companies like Beyond Meat and Unlimeat pushed the boundaries of flavour and texture in plant-based foods, demonstrating that high-quality, nutritious alternatives are increasingly accessible and desirable for mainstream consumers.

Regulatory developments and global adaptation

Globally, regulatory landscapes surrounding cultivated meat and plant-based proteins are evolving. While countries like Thailand have advanced frameworks to facilitate the commercialisation of lab-grown meat, the U.S. saw a more contentious regulatory climate, with some states like Alabama and Florida introducing bans on lab-grown meat. This highlights the ongoing tension between innovation and regulation, especially in regions where traditional agriculture and meat production are vital industries.

The UK has become a strong supporter of plant-based protein innovation, with significant investments in plant-based food research, while Israel’s regulatory push for cultivated fish—like bluefin tuna from Wanda Fish—reflects a growing interest in creating sustainable seafood alternatives. These developments underscore how various nations are positioning themselves in the global race for food system sustainability.

Market shifts towards sustainability

Consumer behaviour reflects the increased awareness of environmental and ethical concerns surrounding animal agriculture, with a growing demand for plant-based and cultivated alternatives. With global issues like climate change and food security in focus, governments and corporations alike are recognising the need for food systems that are less reliant on traditional livestock farming.

Companies in the alternative protein space are adapting to these consumer preferences by emphasising sustainability, with brands like Impossible Foods and Beyond Meat continuing to innovate their products to cater to an eco-conscious market. Furthermore, the increasing popularity of plant-based dairy alternatives and seafood options indicates that consumers are diversifying their dietary preferences, moving away from traditional animal-based products toward more sustainable, plant-forward diets.

A pivotal year for the industry

The developments in the alt-protein industry throughout 2024 illustrate a sector at a crossroads of innovation and regulation. On one side, companies like Aleph Farms and SuperMeat are pushing technological boundaries with advancements in cultivated meat, while others, such as Planted and Beyond Meat, are redefining plant-based offerings. Conversely, legislative bans in regions like Alabama and Florida highlight resistance to this emerging paradigm, often from cultural and economic concerns.

Innovation-driven partnerships, such as Ingredion’s collaboration with Lantmännen and the UK’s £15 million investment in a National Alternative Protein Innovation Centre, underscore the global momentum toward alternative proteins. However, the challenges faced by companies like Eat Just in Singapore signal that regulatory landscapes are as critical as consumer acceptance in shaping the industry’s future.

As we head into 2025, the alt-protein industry must balance scaling innovations, addressing consumer perceptions, and collaborating with policymakers. By fostering transparency, affordability, and taste parity with conventional products, the sector has the potential to overcome barriers and achieve mainstream acceptance. The upcoming year could see alternative proteins transition from being a niche market to a necessity for global food security and environmental sustainability.

Shraddha Warde

shraddha.warde@mmactiv.com

Technology

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News

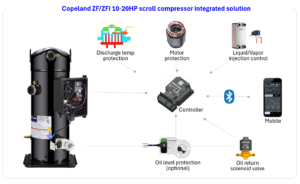

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Nutrition Education Drives Adoption of Seaweed and Mussels among Bangladesh Coastal Communities

Mar 06, 2026 | Food Security

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News