Thursday, 5 March 2026

Kerry’s Interim result shows strong growth in foodservices

Group trading profit margin increased by 60bps, reflecting a 60bps improvement in Taste & Nutrition and a 20bps improvement in Consumer Foods, driven principally by operating leverage. Kerry reports business…

Group trading profit margin increased by 60bps, reflecting a 60bps improvement in Taste & Nutrition and a 20bps improvement in Consumer Foods, driven principally by operating leverage.

Kerry reports business performance for the nine months ended 30 September 2021

Edmond Scanlon, Chief Executive Officer

“We are pleased with overall performance through the period, reflecting continued good growth in our retail channel and strong performance in foodservice. The Americas had good overall volume growth, Europe delivered an excellent performance, while growth in APMEA remained strong with varying conditions across the region. A number of our end use markets had strong performances, with Beverage in particular achieving excellent growth. We have made some significant strategic developments through the year. We further enhanced our position as a market-leading taste & nutrition company, completing the acquisition of Niacet¹ and the sale of our Consumer Foods’ Meats and Meals business. At our recent Capital Markets Day, we shared our refreshed strategic priorities, key growth platforms and mid-term targets, all key enablers of achieving our vision – to be our customers’ most valued partner, creating a world of sustainable nutrition. Our outlook for the full year is unchanged and we expect to deliver strong volume and earnings growth.”

Markets and Performance Overall market conditions have improved through the period, with many developed markets seeing a return to more normalised economic activity. Consumer demand remains strong as retail continues to perform well, while foodservice experiences a continued improvement, as consumers embrace the opportunity for out-of-home social engagement and food consumption. Our markets remain highly dynamic, as customers seek to address heightened consumer demands while balancing labour and supply chain challenges, leading to increased innovation opportunities within our industry. Group reported revenue increased by 6.3% in the period, reflecting a volume increase of 8.2%, increased pricing of 0.7%, an adverse translation currency impact of 3.6% and net contribution from acquisitions and disposals of 1.0%. Group trading profit margin increased by 60bps, reflecting a 60bps improvement in Taste & Nutrition and a 20bps improvement in Consumer Foods, driven principally by operating leverage.

Technology

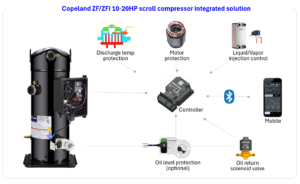

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

WA Scientists Discover New Deep-Sea Crustacean Stocks with Strong Commercial Potential

Mar 05, 2026 | Australia

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Singapore Expands Support for Local Farms to Strengthen Food Security

Mar 05, 2026 | Food Security