Thursday, 5 March 2026

Olam secured three committed loan facilities aggregating US$5.2 billion to facilitate Olam’s Re-organisation Plan

Olam secures landmark US$5.2 billion financings as it progresses on its Reorganisation Leading global food and agri-business, Olam International Limited (“Olam’’) announced that it has secured three committed loan facilities…

Olam secures landmark US$5.2 billion financings as it progresses on its Reorganisation

Leading global food and agri-business, Olam International Limited (“Olam’’) announced that it has secured three committed loan facilities aggregating US$5.2 billion. The three facilities comprise a US$1.2 billion 3-year term loan and two 18-month bridge loan facilities of US$2.0 billion each. The term loan facility will be used for general corporate purposes of the Olam Group while the bridge loan facilities will be used to facilitate Olam’s Re-organisation Plan.

Olam’s Group CFO, N Muthukumar said: “This landmark transaction gives us significant flexibility to allocate financing across our three new operating groups as part of our Reorganisation Plan. We thank our banking partners for their strong commitment and support.” The terms of the three facility agreements include provisions that allow Olam to allocate the facilities to Olam Food Ingredients (“OFI”), Olam Global Agri (“OGA”) and Olam International (“OIL”) operating groups post the carve-out, separation, demerger and IPO of OFI as per the Re-organisation Plan.

The term loan and one of the bridge loan facilities has entities from OFI as Co-Borrowers, while the second bridge loan has entities from OGA and OIL as additional Co-Borrowers. All facilities are guaranteed by Olam. Citibank, JP Morgan Chase Bank, MUFG Bank Ltd. and The Hongkong And Shanghai Banking Corporation Limited (“HSBC”) participated as Senior Mandated Lead Arrangers for the facilities. HSBC is the Facility Agent.

Technology

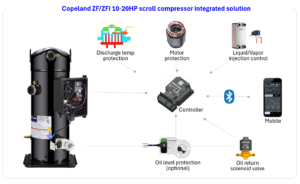

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

WA Scientists Discover New Deep-Sea Crustacean Stocks with Strong Commercial Potential

Mar 05, 2026 | Australia

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

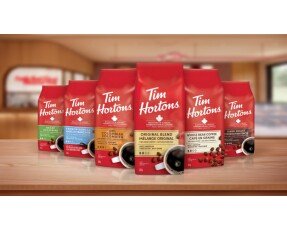

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Singapore Expands Support for Local Farms to Strengthen Food Security

Mar 05, 2026 | Food Security