Saturday, 7 March 2026

Hershey reports Q4 and 2018 full year results

Consolidated net sales was of $7,791.1 million which was an increase of 3.7%. The Hershey Company has announced net sales and earnings for the fourth quarter and full year ended…

Consolidated net sales was of $7,791.1 million which was an increase of 3.7%.

The Hershey Company has announced net sales and earnings for the fourth quarter and full year ended December 31, 2018. The company also provided its 2019 reported net sales and earnings outlook.

“I’m pleased that we delivered our 2018 financial commitments and continued to invest in our future growth,” said Michele Buck, The Hershey Company President and Chief Executive Officer. “The strategic investments we are making in our core confection business have resulted in improved retail trends and margins. Our recently acquired snacking brands continue to generate strong growth and delivered against our financial objectives. And our International business generated a record year of profitability. We are excited to build on this momentum in 2019.”

2018 Full-Year Financial Results Summary

- Consolidated net sales of $7,791.1 million, an increase of 3.7%.

- Constant currency net sales growth of 3.9%, with a 0.2 point headwind from foreign currency exchange.

- The net impact of acquisitions and divestitures was a 3.6 point benefit to net sales growth.

- Reported net income of $1,177.6 million, or $5.58 per share-diluted.

- Adjusted earnings per share-diluted of $5.36, an increase of 14.3%.

All comparisons for full year 2018 are with respect to the full year ended December 31, 2017

Fourth-Quarter 2018 Financial Results Summary

- Consolidated net sales of $1,987.9 million, an increase of 2.5%.

- Constant currency net sales growth of 3.1%, with a 0.6 point headwind from foreign currency exchange.

- The net impact of acquisitions and divestitures was a 3.0 point benefit to net sales growth.

- Reported net income of $336.8 million, or $1.60 per share-diluted.

- Adjusted earnings per share-diluted of $1.26, an increase of 23.5%.

All comparisons for the fourth quarter of 2018 are with respect to the fourth quarter ended December 31, 2017

2019 Full-Year Financial Outlook Summary

- Full-year reported net sales are expected to increase in the 1% to 3% range.

- The net impact of acquisitions and divestitures is estimated to be approximately a 0.5 point benefit.

- The impact of foreign currency exchange is planned to be negligible based on current exchange rates.

- Full-year reported earnings per share-diluted are expected to be in the $5.50 to $5.66 range.

- Full-year adjusted earnings per share-diluted are expected to be in the $5.63 to $5.74 range, an increase of 5% to 7%.

All comparisons for full year 2019 are with respect to the full year ended December 31, 2018

Fourth-Quarter 2018 Results

Consolidated net sales were $1,987.9 million in the fourth quarter of 2018 versus $1,939.6 million in the year ago period, an increase of 2.5%. The net impact of acquisitions and divestitures was a 3.0 point benefit, volume was a 0.9 point benefit and net price realization was a 0.8 point headwind. Foreign currency translation was a 0.6 point headwind.

The company’s fourth-quarter 2018 results, as prepared in accordance with U.S. generally accepted accounting principles (GAAP), included items impacting comparability of $56.1 million, or $0.34 per share-diluted. For the fourth quarter of 2017, items impacting comparability totaled $7.0 million, or $0.17 per share-diluted.

Reported gross margin of 47.5% represented an increase of 430 basis points versus the fourth quarter of 2017. Adjusted gross margin was 42.5% in the fourth quarter of 2018, compared to 42.7% in the fourth quarter of 2017, a decrease of 20 basis points. This was driven by higher freight and logistics costs, as well as incremental investments in trade and packaging.

Advertising and related consumer marketing expense declined 13.3% in the fourth quarter of 2018 versus the same period last year. This was consistent with previous quarters and was driven by optimization of emerging brand spend, reductions in agency and production fees, and media efficiency gains including an increased focus on earned, or non-paid media. Selling, marketing and administrative expenses, excluding advertising and related consumer marketing was in line with the fourth quarter of 2017. A continued reduction in general administrative costs was offset by incremental Amplify selling, marketing and administrative expenses and investment in the multi-year implementation of the company’s enterprise resource planning (ERP) system.

Fourth-quarter 2018 reported operating profit was $421.2 million, resulting in an operating margin of 21.2%. Adjusted operating profit of $368.9 million increased 13.1% versus the fourth quarter of 2017. This resulted in an adjusted operating margin of 18.6%, an increase of 180 basis points versus the fourth quarter of 2017 driven by lower selling, marketing and administrative expenses.

The effective tax rate in the fourth quarter of 2018 was 3.6%, a decline of 2,670 basis points versus the fourth quarter of 2017. The adjusted tax rate in the fourth quarter of 2018 was 9.5%, a decline of 560 basis points versus the fourth quarter of 2017. The decline in both the effective and adjusted tax rates was driven primarily by U.S. tax reform.

Technology

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News

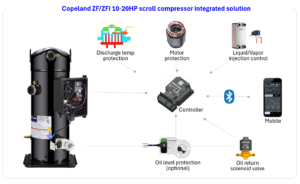

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Nutrition Education Drives Adoption of Seaweed and Mussels among Bangladesh Coastal Communities

Mar 06, 2026 | Food Security

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News