Friday, 6 March 2026

China’s shrimp imports drop by 13% in October

All other top 10 suppliers are trailing year over year, except for Venezuela, which is ahead by 29 per cent and has moved up to 10th place, surpassing countries like…

All other top 10 suppliers are trailing year over year, except for Venezuela, which is ahead by 29 per cent and has moved up to 10th place, surpassing countries like Myanmar and Iran

In October 2024, China saw a 13 per cent decrease in shrimp imports compared to the same month last year; however, the volume increased by 6 per cent compared to September 2024 According to Shripm Insight. Last year, imports followed a downward trend starting in September. If this year’s trend continues to rise, we may observe a year-over-year increase next month. Currently, the cumulative total for the year is 11 per cent lower than that of 2023. By the end of the year, it will likely experience an overall drop of around 10 per cent year over year, bringing the total shrimp imports for 2024 to approximately 890,000 to 900,000 metric tonnes (MT).

Ecuador: Imports from Ecuador decreased by 4 per cent year over year in October 2024, but there was a slight 5 per cent increase compared to September 2024. The cumulative total for the year is now 7 per cent lower compared to the previous year. If this trend continues, the total imports are expected to reach around 650,000 MT by year-end.

India: Imports from India have significantly declined again. Following a 48 per cent drop year over year in September, October 2024 saw a 42 per cent decrease compared to the same month last year. Additionally, October’s imports fell by 6 per cent compared to September 2024. This substantial decline is likely due to competition among Indian processors for raw materials to fulfil orders from U.S. and EU customers. Currently, the year-to-date total is down by 6 per cent, and if this trend continues, imports are likely to be around 125,000 to 135,000 MT by the end of the year.

Argentina: Although imports from Argentina increased by 20 per cent in October year over year, the country still needs to make up a 48 per cent deficit for the year’s total.

All other top 10 suppliers are trailing year over year, except for Venezuela, which is ahead by 29 per cent and has moved up to 10th place, surpassing countries like Myanmar and Iran.

Regarding average import prices, Ecuador’s prices have remained relatively stable at $4.54 per kilogram. In contrast, India’s prices surged from $5.13 to $5.88. This increase may be attributed to a shortage of raw materials in India and the intense competition among processors to secure necessary supplies for their customers.

Technology

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News

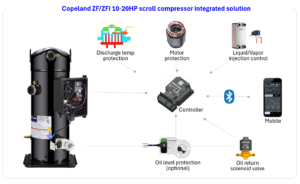

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Nutrition Education Drives Adoption of Seaweed and Mussels among Bangladesh Coastal Communities

Mar 06, 2026 | Food Security

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News