Thursday, 5 March 2026

Olam secures US$4.0 billion financing for its Re-organisation plan

Olam’s Group CFO and CEO (Operations), N Muthukumar said: “The signing of these facilities is yet another milestone in our Re-organisation plan to unlock value for our stakeholders. Leading global…

Olam’s Group CFO and CEO (Operations), N Muthukumar said: “The signing of these facilities is yet another milestone in our Re-organisation plan to unlock value for our stakeholders.

Leading global food and agri-business, Olam International Limited (“Olam’’) announced that it has secured multiple bank facilities aggregating US$4.0 billion, as it continues to progress on its Re-organisation Plan.

The facilities comprise a US$1.5 billion committed facility with a flexible tenor of up to 3 years (“Facility A”), a US$1.0 billion working capital facility (“Facility B”) and an US$1.5 billion total increase across the 2 bridge loan facilities announced in August 2021 (“Facility C”) and will be used to facilitate the allocation of existing debt to the new operating groups.

Olam’s Group CFO and CEO (Operations), N Muthukumar said:

“The signing of these facilities is yet another milestone in our Re-organisation plan to unlock value for our stakeholders. These facilities offer us additional flexibility to allocate financing in-line with the capital structure for our three operating groups.”

The Facility A and Facility C agreements include provisions that allow Olam to allocate the facilities to Olam Food Ingredients (“OFI”), Olam Global Agri (“OGA”) and Olam International (“OIL”) operating groups post the carve-out, separation, demerger and IPO of OFI as per the Re-organisation Plan. The Facility B agreement has OGA and its treasury entity as co-borrowers.

Technology

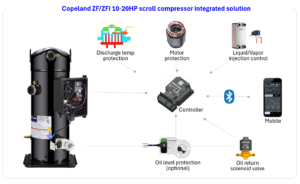

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

WA Scientists Discover New Deep-Sea Crustacean Stocks with Strong Commercial Potential

Mar 05, 2026 | Australia

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Singapore Expands Support for Local Farms to Strengthen Food Security

Mar 05, 2026 | Food Security