Thursday, 26 February 2026

Davis Commodities evaluates $1Bn ESG-tokenised yield corridor to link Asia, Africa and Latin America

This corridor concept seeks to digitally align Asia–Africa–Latin America trade routes, bridging capital demand with verified supply chains through programmable finance rails Davis Commodities Limited announced that it is evaluating…

This corridor concept seeks to digitally align Asia–Africa–Latin America trade routes, bridging capital demand with verified supply chains through programmable finance rails

Davis Commodities Limited announced that it is evaluating the creation of an inter-regional, ESG-tokenised yield corridor built around its Real Yield Token (RYT) ecosystem and certified commodity finance. This corridor concept seeks to digitally align Asia–Africa–Latin America trade routes, bridging capital demand with verified supply chains through programmable finance rails.

A tokenised yield corridor refers to a programmable finance infrastructure designed to connect investors, trade flows, and ESG-certified assets across multiple regions. By linking agricultural commodity transactions with blockchain settlement and digital yield instruments, the model aims to reduce friction, improve transparency, and open new access points for sustainable finance.

$1 billion projected yield corridor capitalisation under staged rollouts

Integration of stablecoin settlement engines with agricultural commodity financing to reduce friction across multiple FX zones

An estimated 50 per cent–80 per cent efficiency gains in trade settlement costs compared to legacy SWIFT-based systems

The ability to channel ESG-compliant commodities, potentially unlocking $ 250 million+ in blended finance opportunities annually

The proposed corridor would embed recognised sustainability certifications—such as Bonsucro (Sugar) and ISCC (Rice)—directly into tokenised yield flows. This integration may allow impact funds, sustainability-linked institutional investors, and regional trade financiers to access verified commodity-backed yield instruments at scale.

Tokenised corridors and treasuries are gaining traction globally as financial institutions and fintech leaders test on-chain reserve frameworks to improve transparency and capital efficiency. Davis Commodities’ exploration aligns with these precedents, focusing on emerging-market trade corridors often underserved by traditional capital systems.

Technology

Deakin University and Bellarine Foods Partner to Develop Sustainable Marine-Derived Proteins

Feb 26, 2026 | Australia

Royal Unveils Refreshed Jute Bag Design for 20lb Authentic Basmati

Feb 25, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Food Testing

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

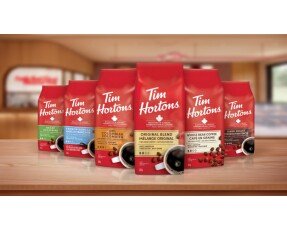

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

UAE’s Cult Mochi Brand MOISHI Makes India Entry with CK Israni Group

Feb 26, 2026 | Company News

Roquette Launches Breakthrough Clean-Tasting Pea Protein Isolate

Feb 26, 2026 | Company News

Affron Saffron Attains First Stress Relief Claim by South Korean Ministry of Food and Drug Safety

Feb 26, 2026 | Company News