Saturday, 7 February 2026

Burger King acquires Carrols Restaurant Group

The Company will invest a further $500M to accelerate the reimaging of more than 600 Carrols restaurants before franchising the majority of the acquired portfolio to new or existing smaller franchise operators…

The Company will invest a further $500M to accelerate the reimaging of more than 600 Carrols restaurants before franchising the majority of the acquired portfolio to new or existing smaller franchise operators over the next seven years

Restaurant Brands International (RBI) announced that it has completed its previously announced acquisition of all issued and outstanding shares of Carrols Restaurant Group, Inc. that are not already held by RBI or its affiliates for $9.55 per share in an all-cash transaction, or an aggregate total enterprise value of approximately $1.0 billion.

With the close of the acquisition, RBI added the largest Burger King (BK) franchisee in the United States to its portfolio as part of the Company’s Reclaim the Flame plan. As previously announced, the Company will invest a further $500M to accelerate the reimaging of more than 600 Carrols restaurants before franchising the majority of the acquired portfolio to new or existing smaller franchise operators over the next seven years.

In addition, on May 16, 2024, subsidiaries of RBI entered into an amendment to their existing Credit Agreement increasing the existing term loan B facility with $5.2 billion outstanding to a $5.9 billion term loan B facility under the same terms as the existing Term Loan B Facility. The proceeds from the increase in the Term Loan B Facility were used along with cash on hand to complete the acquisition of Carrols, including the payoff of its credit agreement and the redemption and discharge of its outstanding 5.875 per cent senior notes due 2029.

Technology

Australia Approves Commercial Release of GM Purple Tomato

Feb 06, 2026 | Australia

Detmold Group Reports Progress on Emissions Reduction, Circular Packaging Goals

Feb 05, 2026 | Australia

FAO on Balancing Climate Urgency and Food Safety in Emerging Agrifood Technologies

Feb 05, 2026 | Food Security

Food Testing

AFNOR International Eyes Global Food Safety Growth with HACCP Group Takeover

Feb 04, 2026 | Australia

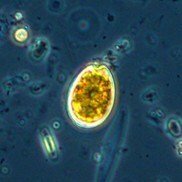

Incheon National University researchers uncover hidden toxin risks during nutrient-starved algal blooms

Feb 02, 2026 | Food Safety and Testing

How audit-led approaches are reinforcing trust in retail food safety

Feb 02, 2026 | Food Safety and Testing

More Popular

Fertility Meets Farm-to-Table Dining with Launch of ‘The Fertility Table’ in India

Feb 06, 2026 | Company News

Australia Approves Commercial Release of GM Purple Tomato

Feb 06, 2026 | Australia

Alternative Proteins Could Add €111 Billion Annually to EU Economy by 2040, Study Finds

Feb 06, 2026 | Europe