Thursday, 5 March 2026

Missfresh reached new milestone by listing over FTSE Global Equity Indices

Missfresh Limited an innovator and leader in China’s neighborhood retail industry, announced that it will be added to the FTSE Global Equity Index Series Missfresh Limited an innovator and leader…

Missfresh Limited an innovator and leader in China’s neighborhood retail industry, announced that it will be added to the FTSE Global Equity Index Series

Missfresh Limited an innovator and leader in China’s neighborhood retail industry, announced that it will be added to the FTSE Global Equity Index Series (“FTSE GEIS”) – FTSE China Indices, FTSE Global Micro Cap Index and FTSE Global Total Cap Index, effective after the close of business on Friday, December 17, 2021. This marks the first period since Missfresh’s IPO earlier this year that the Company has been eligible for inclusion in these indices, in accordance with FTSE Russell’s quarterly review changes released on November 19, 2021.

“Missfresh’s addition to the FTSE Global Equity Index Series represents another milestone in increasing our visibility and exposure across the global investment community,” commented Mr. Zheng Xu, founder, chairman and CEO of Missfresh. “Recognition by one of the most reputable and recognized global equity indices in the world reflects Missfresh’s solid growth potential in the near- and long-term. In our pursuit of high quality, sustainable growth, we are dedicated to boosting digital transformation across China’s neighborhood retail industry. With this momentum, we continue to bring superior experiences and elevated efficiency to our growing customer base and business partners, driving value for all of our stakeholders.”

FTSE Russell is a global index leader that provides innovative benchmarking, analytics and data solutions for investors worldwide, calculating thousands of indexes that measure and benchmark markets and asset classes in more than 70 countries, covering 98% of the investable market globally. FTSE Russell index expertise and products are used extensively by institutional and retail investors globally. FTSE GEIS provides a robust global equity index framework. The series includes over 16,000 large, mid, small, and micro cap securities across 49 developed and emerging markets globally, with a wide range of modular indexes available to target specific markets and market segments.

Technology

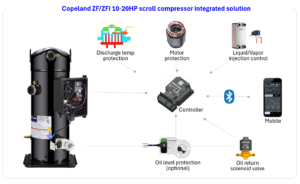

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

WA Scientists Discover New Deep-Sea Crustacean Stocks with Strong Commercial Potential

Mar 05, 2026 | Australia

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Singapore Expands Support for Local Farms to Strengthen Food Security

Mar 05, 2026 | Food Security