Friday, 6 February 2026

Sovos Brands acquires Rao’s Speciality Foods

Rao’s Specialty Foods is the second acquisition in less than six months for Sovos, which seeks to acquire and build value in one-of-a-kind food and beverage brands. Sovos Brands, a…

Rao’s Specialty Foods is the second acquisition in less than six months for Sovos, which seeks to acquire and build value in one-of-a-kind food and beverage brands.

Sovos Brands, a new food and beverage company formed by Advent International has agreed to acquire Rao’s Specialty Foods, Inc. The transaction is expected to be completed during the third quarter of this year. Financial terms were not disclosed.

Rao’s Specialty Foods is the second acquisition in less than six months for Sovos, which seeks to acquire and build value in one-of-a-kind food and beverage brands. In January 2017, the company purchased Michael Angelo’s Gourmet Foods, a leading producer of premium, authentic frozen Italian entrées. Headquartered in Berkeley, CA, and led by seasoned consumer packaged goods executives, Sovos focuses on high-quality brands in on-trend categories with the potential to accelerate growth by investing in distribution, marketing, production and product innovation.

Rao’s Specialty Foods, which manufactures the Rao’s Homemade brand, was established in 1992. Sovos Brands said the business is a “super-premium” brand with a focus on the “highest quality ingredients, clean label and superior taste profile”.

Spearheading the acquisition and value creation initiatives at Sovos Brands is a team headed by Mr. Lachman, Larry Bodner, CFO, and Bill Johnson, Chairman. Mr. Lachman has a 25-year record of delivering growth and value creation as a senior executive at major consumer products companies, including Mars, Del Monte Foods, H.J. Heinz and Procter & Gamble. Mr. Bodner has over 25 years of experience as a performance-driven financial executive at companies including Big Heart Pet Brands, Del Monte Foods, Walt Disney and Procter & Gamble. Mr. Johnson was formerly chairman, CEO and president of H.J. Heinz, where he had a distinguished 31-year career, transforming the company into a global food industry leader.

The transaction does not include the iconic Rao’s restaurants in New York, Las Vegas and Los Angeles, which will remain under current ownership.

Advent International has significant investment experience in the retail, consumer and leisure industry. Over the past 27 years, the firm has invested more than $9 billion in 71 companies in the sector across 21 countries worldwide. In addition to Sovos Brands, recent North American investments include Noosa Yoghurt, lululemon athletica, The Coffee Bean & Tea Leaf, Serta Simmons Bedding, Party City, Bojangles’ and Five Below.

Morgan Stanley & Co. LLC is serving as exclusive financial advisor and Morrison & Foerster LLP is serving as legal advisor to Rao’s Specialty Foods on the transaction. Weil, Gotshal & Manges is serving as legal advisor to Sovos Brands and Advent International.

Technology

Australia Approves Commercial Release of GM Purple Tomato

Feb 06, 2026 | Australia

Detmold Group Reports Progress on Emissions Reduction, Circular Packaging Goals

Feb 05, 2026 | Australia

FAO on Balancing Climate Urgency and Food Safety in Emerging Agrifood Technologies

Feb 05, 2026 | Food Security

Food Testing

AFNOR International Eyes Global Food Safety Growth with HACCP Group Takeover

Feb 04, 2026 | Australia

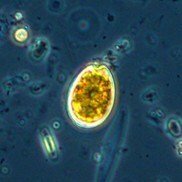

Incheon National University researchers uncover hidden toxin risks during nutrient-starved algal blooms

Feb 02, 2026 | Food Safety and Testing

How audit-led approaches are reinforcing trust in retail food safety

Feb 02, 2026 | Food Safety and Testing

More Popular

Fertility Meets Farm-to-Table Dining with Launch of ‘The Fertility Table’ in India

Feb 06, 2026 | Company News

Australia Approves Commercial Release of GM Purple Tomato

Feb 06, 2026 | Australia

Alternative Proteins Could Add €111 Billion Annually to EU Economy by 2040, Study Finds

Feb 06, 2026 | Europe