Saturday, 7 March 2026

Nutraceutical, Functional Foods, and Dietary Supplements Industry Market in Asia

The Asia Pacific nutraceuticals product market is growing rapidly. The market was valued at USD 59.55 billion in 2016 and is estimated to reach USD 89.63 billion by 2021, growing…

The Asia Pacific nutraceuticals product market is growing rapidly. The market was valued at USD 59.55 billion in 2016 and is estimated to reach USD 89.63 billion by 2021, growing at a compound annual growth rate (CAGR) of 8.52% in the period of 2016 to 2021.

The Asia Pacific nutraceuticals product market is growing rapidly. The market was valued at USD 59.55 billion in 2016 and is estimated to reach USD 89.63 billion by 2021, growing at a compound annual growth rate (CAGR) of 8.52% in the period of 2016 to 2021.

The functional food ingredients market is expected to expand at a CAGR of 5.9% in terms of value during the period 2016 to 2026 and is expected to reach USD 5.04 billion by the end of 2026.

This growth is driven by increase in consumers’ awareness of health and fitness; rise in disposable income and middle-class consumers in countries such as India and China; ageing populations; urbanization; increase in incidence of lifestyle related diseases such as blood pressure, diabetes, and cardiac diseases; inadequate nutrition due to the consumers’ busy lifestyle and high cost of healthcare, to name a few.

Dieticians and nutritionists are recommending dietary supplements and functional food to their clients in the Asia Pacific region to remain healthy. A number of global multinational in nutraceutical products, including fast-moving consumer goods (FMCG) and pharmaceutical companies, have penetrated the Asia Pacific market to cater to this growing demand.

Their products reach the consumers through multiple retail formats/channels such as stand-alone pharmacy and health stores, direct selling, e-tailing and supermarkets, among others.

The nutraceuticals product market is segmented into animal nutrition, functional food, dietary supplements, functional food beverages and personal care, to name a few. Dietary supplements segment of the nutraceutical industry leads the Asia Pacific market, while the functional foods segment is growing at a fast pace.

In terms of sales, while the dietary supplement sales have been captured mainly by pharmaceutical companies, functional foods and beverages are being brought to the market by the FMCG companies.

If one examines some of the fast growing markets in the Asia Pacific such as India and China, historically, these countries have used traditional and natural forms of alternative medicines and dietary supplements. Some of the well-known indigenous dietary supplements in India are Chyawanprash and Ashwagandha, which have been used in Ayurveda for thousands of years, offering a wide range of health benefits. Ginseng is one of the most popular herbal medicines is countries such as China and Korea which is used as a supplement to boost the immune system.

Japan is the most developed market for nutraceuticals in the Asia Pacific region. It is also the largest consumer of nutraceuticals products in the region, followed by China. The Japanese and Chinese nutraceutical markets are expected to have market shares of 54.8% and 39.5% respectively of the Asia Pacific nutraceuticals market in 2017.

Existing studies by consultancy organisations show that the Indian nutraceuticals market will continue to experience a high growth rate of approximately 16% in the next five years and is expected to grow to approximately USD 4 billion by 2020.

Although the present size of the market is small, Indian consumers are gradually generating preference for nutraceutical products as an alternative for pharmaceutical medicines as they are becoming more aware about natural supplements and the benefits they provide for good health. In India, a survey conducted by the National Sample Survey Organisation (NSSO) on the Nutritional Intake in India (2011-12) found that, since the year 2000, there has been a sharp decline in calorie intake in both urban and rural India resulting in low nutrition levels.

The Indian Ministry of Health and Family Welfare has now focused on the need to reduce malnutrition through various programmes. For example, in order to overcome the malnutrition associated with Vitamin A, a programme to provide Vitamin A supplements to children of different age groups has been implemented.

The National Health Policy (2017) aims at addressing micronutrient deficiency by augmenting initiatives like micro nutrient supplementation, food fortification, screening for anaemia and public awareness. Such initiatives are likely to boost up the demand for dietary supplements.

Other Asia Pacific markets are also catching up and driving the growth of the market. Singapore is showing increasing demand for nutraceuticals due to a growing cosmopolitan culture; Malaysia is facing dramatic changes in urban lifestyles, which is creating health and nutrition problems with rapid increases in obesity, hypertension, and heart diseases. In this country nutraceuticals industry is expected to grow at a CAGR of 7% by 2019 .

In spite of the high growth, there are a few constraints that the nutraceutical industry is facing in the Asia Pacific region. Within the industry, there is growth of some segments, such as dietary supplements and functional foods, while growth of other segments is low due to lack of knowledge. Further, consumers are price conscious and in developing countries purchasing power is low. The nutraceutical products often have premium prices and are, therefore, affordable to only certain segments of the population (upper class, upper-middle class, etc.).

Consumer awareness in the region is low and a large segment of the population is not aware of the benefits of consuming nutraceutical products. Quality of nutraceutical product is also an issue and there can be spurious products in the market, which can have harmful health impacts. Policies related to retail, online sales, etc., are evolving in countries such as India.

Another major issue is that there is also no official definition of the term “nutraceuticals” given by any global authority engaged in food and public health such as the World Health Organization, International Food Safety Authorities Network, Food and Agriculture Organization of the United Nations, etc. These products are generally defined as foods or food-derived substances, which claim to provide medicinal and health benefits.

This has caused regulatory issues in some countries leading to questions such as: Who should be the nodal agency regulating this sector? What should be the product standards and label? How to detect and address fraudulent practices? These issues have to be addressed by the countries through right policies and in a number of Asia Pacific countries, policies and guidelines related to nutraceutical products are still evolving.

To conclude, the Asia Pacific market for nutraceutical products is growing but can grow faster through right policies. Further, this region has some indigenous nutraceutical products which can be exported. To promote the growth of this sector there is need for consumer awareness and policy guidelines, similar to those in the developed countries.

Technology

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News

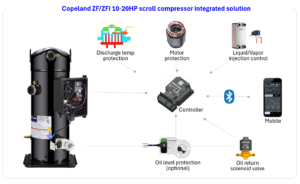

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Nutrition Education Drives Adoption of Seaweed and Mussels among Bangladesh Coastal Communities

Mar 06, 2026 | Food Security

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News