Friday, 6 March 2026

Global trends in plant-based market Asia-Pacific’s growing influence

Christian Philippsen, Managing Director at BENEO Asia Pacific, shares his expertise on global trends, and regional adoption in Asia-Pacific with NUFFOODS Spectrum The plant-based food industry is undergoing a dynamic…

Christian Philippsen, Managing Director at BENEO Asia Pacific, shares his expertise on global trends, and regional adoption in Asia-Pacific with NUFFOODS Spectrum

The plant-based food industry is undergoing a dynamic transformation, driven by shifting consumer preferences, sustainability concerns, and advancements in food technology. As more consumers embrace flexitarian and plant-based diets, manufacturers are responding with innovative solutions to meet their expectations for taste, texture, and nutritional value.

To gain deeper insights into the evolving plant-based market, Christian Philippsen, Managing Director at BENEO Asia Pacific, shares his expertise on global trends, regional adoption in Asia-Pacific, and the key factors shaping the industry’s future with NUFFOODS Spectrum. In this interview, he discusses the challenges and opportunities in plant-based innovation, localisation strategies, and how emerging technologies are driving sustainable food solutions.

What are the current global trends in the plant-based market, and how does the Asia-Pacific region compare in growth and adoption?

The plant-based diet has seen a remarkable rise in popularity globally, driven by a growing focus on health, sustainability, and animal welfare. Asia in particular, is no stranger to this green food trend, with the region expected to dominate the plant-based protein market by 2030, reaching a value of $64.8 billion. As more consumers turn to meat alternatives, the food industry has responded with a surge in innovative products and plant-based options, making them more accessible and appealing.

That said, after years of constant growth, the plant-based market is not averse to global challenges such as rising cost-of-living and inflation, supply chain disruptions, and consumer confusion about what constitutes a truly plant-based diet, as some products may be marketed as “plant-based” while still being highly processed or containing artificial ingredients.

The good news is, that new research from Innova Market Insights shows that while the effects of high food price inflation and the need to cut back are still affecting consumer markets worldwide, eye-catching or well-loved ingredients, nature-friendly claims, as well as health benefits will increasingly inspire higher spending.

Another trend BENEO is observing as a global company is that when it comes to plant-based meat alternatives, there is more hesitation within the Asian food industry to develop products compared to Western markets. We see one explanation for that in the fact that Asian cuisine traditionally consists of a lot of vegetables as well as plant-based protein sources such as tofu or tempeh, potentially decreasing the need for ‘new generation’ meat substitutes. However, it is worth noting that in urban nations such as Singapore, diners are increasingly health-conscious, environmentally aware, and receptive to the plant-based meat movement. In fact, according to a 2023 Euromonitor International report, Singapore’s plant-based food market is projected to grow at an annual rate of 7.2 per cent over the next five years.

With the rise of the flexitarian diet, what factors are most important for encouraging repeat purchases of plant-based alternatives?

Knowing your consumer is half the battle won. Understanding the key motivations and expectations for plant-based purchasing is vital for product development and success in a market that is rapidly growing and changing. BENEO’s earlier plant-based consumer survey shows that one in four consumers globally now identify as flexitarians, and Asia is leading the way with 28 per cent of consumers describing their diet as flexitarian. This makes them the most important target group for manufacturers of plant-based products to effectively tap into this trend. According to BENEO’s research, approximately half of flexitarians buy meat alternatives (45 per cent) and dairy (49 per cent), with almost 1 in 3 also buying plant-based sweets like chocolate (32 per cent). Furthermore, there is room for more growth amongst flexitarian consumers, with an additional third interested in buying dairy and meat alternatives in the future and 42 per cent wanting to explore sweet alternatives.

How can companies innovate by offering diverse plant-based options to create exciting new combinations while maintaining desirable textures?

When it comes to consumer expectations, it was found that the top drivers for flexitarian purchasing for meat and dairy alternatives boil down to how natural the ingredients used are, whether they help consumers take care of their bodies and the variety they bring to consumer diets. Not surprisingly, taste also emerged as a key driver for repeat purchases.

Even though taste is an important buying incentive for flexitarians, the issue remains that 28 per cent of Asian consumers believe plant-based food and drinks taste bland. However, thanks to the variety of ingredients available for reformulation, there exists a wide range of meat- and dairy alternative recipes that are now possible.

For example, BENEO’s Nutriz range supports plant-based sweets and confectionaries that are dairy-free. In addition, BENEO’s faba bean concentrate, allows for full or partial egg-replacement in bakery reformulations, while also retaining similar crumb structure and firmness, as well as taste. Another option is Orafti® β-Fit. As a 100 per cent wholegrain flour made from barley, this ingredient provides 20 per cent beta-glucan fibres — which is significantly higher than conventional cereal flours. It also features a clean taste and neutral colour for seamless integration into various formulations.

Dairy-free coffee creamers, meat-free dumpling fillings, and plant-based cocoa bars are just some of the numerous options available to not only deliver the nutritional needs of consumers but also meet taste and texture expectations. Ultimately, it is about finding the right choice of plant-based protein sources. There is no one-size-fits-all approach, and this is where BENEO comes in to support our customers along their development journey.

How can the plant-based industry address concerns around nutritional value to attract a broader audience?

The amino acid profiles of protein sources are crucial. For example, faba and rice — both part of BENEO’s portfolio — complement each other very well so that a full amino acid profile can be achieved.

Besides taste and texture as key motivators, flexitarians also lean towards products with nutritional claims that include ‘natural ingredients’, ‘low environmental impact’, and ‘additive-free’. For all plant-based applications, delivering a better nutritional profile is crucial and brands need to build their ‘better-for-you’ credentials to appeal more convincingly to flexitarians. It is therefore no surprise that on-pack messaging that re-enforces clean and cleaner label priorities is proving popular.

In alignment with this trend, BENEO’s speciality rice ingredients are ideal clean-label texturising ingredients which can be used in dairy, bakery, and chocolate alternatives. BENEO’s Nutriz range, which consists of blends of dried rice syrup, rice flour and rice starch, was extended to give manufacturers more formula options and offers clean label and allergen-free ingredients. With a light colour and neutral taste, this milk powder replacement is ideal for use in dairy-free chocolate and as a bulking agent to make rice-based dairy alternatives. It also enables the development of plant-based cocoa bars that provide a nice taste, good snap, smooth mouthfeel and good melting behaviour. In addition, using Nutriz in dairy alternative drinks and desserts helps to create a smooth and full-bodied mouthfeel similar in texture to dairy drinks. A combination of taste, texture and accurate clean-label guarantee will go a long way in enabling manufacturers to reformulate better to meet consumer expectations.

What are the biggest challenges in scaling the production of plant-based alternatives while maintaining product quality and affordability?

Delivering diversity, while keeping costs in check. Creating a really convincing organoleptic profile, it is often about the combination of different plant-based ingredient solutions. To assist in this process, BENEO has a broad toolbox of ingredients available, with the more recent portfolio extensions being faba bean protein concentrates. Additionally — with our recent acquisition of the Dutch company Meatless B.V. — BENEO offers textured plant-based ingredients derived from various raw materials such as rice, faba beans, wheat, pea and quinoa. We are excited as the range fully complements BENEO’s ingredients portfolio and allows for exciting new combinations for the development of meat and fish alternatives.

How important is product localization in the plant-based market, especially in culturally diverse regions like Asia-Pacific?

The Asia Pacific region is home to a rich tapestry of diverse cuisines and cultures. However, this diversity also presents a unique challenge when it comes to localising plant-based offerings, as consumer preferences, traditional eating habits, and flavour profiles vary significantly across the region. An additional layer of challenge lies in replicating traditional Asian dishes which contain meat or seafood in a way that delivers convincing sensory profiles. As the market continues to grow and flow, innovation with cultural authenticity is key to successfully tapping into this vibrant market while respecting its culinary heritage. To this end, BENEO recently expanded its Asia Pacific Regional Application Centre in Singapore, with a team tasked with developing solutions that are tailored to different market needs and regional taste buds.

What emerging technologies or innovations are shaping the future of plant-based food production?

There are certainly many approaches, starting from the way to cultivate crops more efficiently and sustainably, to unconventional processing methods such as 3D printing. Remaining within our expertise as a provider of natural plant-based solutions, we aim to make the production process as sustainable as possible while offering proteins derived from raw materials like faba beans and rice. For example, the production process of our faba bean protein concentrate runs on renewable electricity, uses no processed water, and ensures 100 per cent of the faba bean is utilised in food and feed applications. From farm to fork, our faba bean protein is a plant-based solution that supports a sustainable food system while aligning with consumers’ aspirations for a responsible and healthy lifestyle.

How do plant-based brands balance the demand for clean-label products with the need for functional ingredients to replicate taste and texture?

Here, scalability is the key aspect. In the plant-based arena, it is still challenging to combine high-quality taste and texture with scalability and a competitively priced plant-based alternative. Due to our acquisition of Meatless, BENEO has a unique and patented processing technology available which allows us to create semi-finished products in an easily scalable way. The highly automated process therefore delivers crucial cost efficiencies for food manufacturers in today’s economic climate.

How does consumer perception of plant-based alternatives differ across key global markets, and what can brands do to address these variations?

For manufacturers, it is crucial to know the demands of the target group they want to reach. Take for instance ‘meat lovers’ who skip traditional meat for health or ethical reasons, but don’t want to miss the taste experience. Convincing them to turn to plant-based alternatives, manufacturers have to deliver meat substitutes which offer equal taste and indulgence as ‘the real thing’. This is different for younger consumers, where it is often not about replicating sensory properties but rather creating their own, individual taste experience with the power of plant-based proteins. One global study found that seven in 10 consumers have the desire to experience interesting textures, and to be surprised in some way. Zooming into the Asia Pacific region, it was found that countries such as the Philippines have almost eight in 10 consumers saying that eating and drinking is the main way they connect with family and friends. We see in Europe, North America, and ANZ that consumers have more focus on sustainability and animal welfare, so brands tend to highlight environmental benefits and use clean-label ingredients. In Asia, where the diet is already significantly plant-based, these ingredients are seen more as a premium alternative, and brands have to localise to appeal to consumers.

With South Korea’s recent ban on breeding, slaughtering, and selling dogs for human consumption, could this indicate the potential for the country to become a significant market for plant-based meat? What strategies should companies adopt to tap into this opportunity effectively?

South Korea’s interest in sustainable consumption and plant-based food has grown steadily. According to a report from FMCG Gurux, 18 per cent of South Korean consumers state to not eat meat at all and 30 per cent don’t consume meat regularly but sometimes – hence following a flexitarian diet. A Statista report showed that increasingly, well-established major food companies are launching new products in the meat substitute market. According to the Korean International Trading Agency (KITA), plant-based substitutes will lead the South Korean meat market in 2040.

Shraddha Warde

shraddha.warde@mmactiv.com

Technology

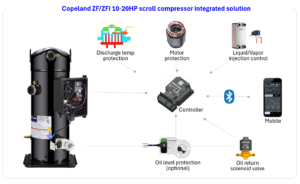

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

WA Scientists Discover New Deep-Sea Crustacean Stocks with Strong Commercial Potential

Mar 05, 2026 | Australia

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Singapore Expands Support for Local Farms to Strengthen Food Security

Mar 05, 2026 | Food Security