Friday, 27 February 2026

BreadTalk prices S$100m of five-year notes to yield 4%

Proceeds from the bonds, which will be sold at par and which mature on Jan 17, 2023, will be used for general corporate purposes. Breadtalk Group has priced S$100 million…

Proceeds from the bonds, which will be sold at par and which mature on Jan 17, 2023, will be used for general corporate purposes.

Breadtalk Group has priced S$100 million of five-year notes at a coupon of 4 per cent under an existing S$250 million medium-term note programme, the bakery and restaurant operator announced recently.

Proceeds from the bonds, which will be sold at par and which mature on Jan 17, 2023, will be used for general corporate purposes. These purposes include refinancing of existing borrowing and financing capital expenditure and general working capital.

OCBC Bank and Standard Chartered Bank are the joint lead managers and bookrunners for the notes.

The company had S$45 million of borrowings and debt securities repayable within one year as at Sept 30, 2017; and an additional S$114 million repayable after one year.

Technology

Ingredion Thailand Achieves 100% Sustainably Sourced Cassava

Feb 27, 2026 | Company News

Deakin University and Bellarine Foods Partner to Develop Sustainable Marine-Derived Proteins

Feb 26, 2026 | Australia

Royal Unveils Refreshed Jute Bag Design for 20lb Authentic Basmati

Feb 25, 2026 | Company News

Food Testing

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

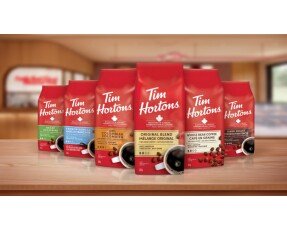

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Arla Foods Invests EUR 300Mn in New Cheese Dairy in Sweden

Feb 27, 2026 | Company News

Beyond Meat Broadens Portfolio Beyond Protein with Sparkling Plant-Based Drink Line

Feb 27, 2026 | Beverages

Prinova to Spotlight Nutrition Innovations at Natural Products Expo West 2026

Feb 27, 2026 | Company News