Saturday, 7 March 2026

Magners owner C&C acquires Admiral Taverns

The move, taken alongside investment company Proprium Capital Partners provides further evidence of the strong appetite for dealmaking in the pub sector Magners owner C&C has acquired Admiral Taverns alongside…

The move, taken alongside investment company Proprium Capital Partners provides further evidence of the strong appetite for dealmaking in the pub sector

Magners owner C&C has acquired Admiral Taverns alongside a US investment fund.

The Irish drinks giant, which also owns Bulmers cider and Scottish beer brand Tennent’s, is investing £37m to acquire 47pc of Admiral.

The move, taken alongside investment company Proprium Capital Partners provides further evidence of the strong appetite for dealmaking in the pub sector.

It follows Heineken’s acquisition of Punch Taverns in a £403m move last year, while there is also a £100m battle for Revolution Bars, which is being eyed up by Slug and Lettuce owner Stonegate Pubs and nightclub company Deltic.

Stephen Glancey, C&C chief executive said, “For us it provides market access. So we will be able to drive our brands through their estate over time.”

“Vertical integration in the UK has always been a successful model. You have Fuller’s and Young’s, for example – they own pubs and they own breweries. That secures a space in the bar for their brands and they use that to enhance the business.For brewers and drinks companies to have some sort of ability to influence the choice in pubs is still very relevant.”

“I think the pressure will be more on the food-led operations. Particularly with the explosion of casual dining and all these chains competing very hard with pub companies”, he added.

Admiral’s management will remain at the helm of the business, which C&C is expecting to provide mid-single digit earnings and “attractive returns on equity” in the first full financial year after the deal is finalised. The transaction is expected to be completed by the end of November.

Kevin Georgel, the chief executive of Admiral, said, “Recent years have seen Admiral Taverns go from strength to strength and I am delighted that with the support of our new investors we will have the platform in place to continue our development and execute our growth plans.”

Davy analyst Cathal Kenny said, “The deal “makes sense for brand owners such as C&C”. The transaction structure means C&C is not taking significant financial or operational risk. The investment will bolster C&C’s presence in the on-trade channel (England and Wales), where its core cider brands are under-represented.”

Technology

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News

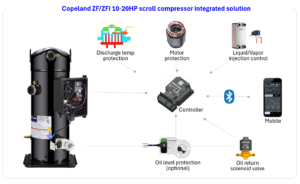

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Nutrition Education Drives Adoption of Seaweed and Mussels among Bangladesh Coastal Communities

Mar 06, 2026 | Food Security

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News