Thursday, 12 February 2026

Unilever Reports Resilient 2025 Performance; Foods Business Delivers Steady Growth

Within the portfolio, the Foods business delivered 2.5 per cent underlying sales growth, driven primarily by emerging markets Unilever delivered improved underlying sales growth and stronger margins in 2025, as…

Within the portfolio, the Foods business delivered 2.5 per cent underlying sales growth, driven primarily by emerging markets

Unilever delivered improved underlying sales growth and stronger margins in 2025, as it accelerated portfolio reshaping and sharpened execution across markets.

“In 2025, we became a simpler, sharper, and faster Unilever, delivering our commitment to volume growth, positive mix and strong gross margin,” said CEO Fernando Fernandez. “Our underlying sales growth improved throughout the year as we landed a strong innovation plan, drove improvements in key emerging markets and completed the Ice Cream demerger. Despite slowing markets, our sharper focus and disciplined execution underpin our confidence for 2026 and beyond.”

Group turnover was €50.5 billion, down 3.8 per cent, reflecting currency headwinds and disposals. Underlying operating profit stood at €10.1 billion, down 1.1 per cent, while operating margin improved 60 basis points to 20.0 per cent.

Within the portfolio, Foods underlying sales grew 2.5 per cent, with 0.8 per cent from volume and 1.7 per cent from price, driven by strong performance in emerging markets. Developed market growth was flat despite declining categories, supported by Hellmann’s, which benefited from its flavoured mayonnaise range across more than 30 markets. Fourth-quarter growth was 2.3 per cent, with 1.3 per cent from volume.

Cooking Aids grew low-single digit, primarily price-led, while Knorr delivered low-single digit growth, with emerging market gains offsetting softer developed markets. Condiments posted mid-single digit growth with balanced volume and price; Hellmann’s grew mid-single digit, led by volume and premiumisation, particularly in emerging markets. Unilever Food Solutions was flat, as North America volume gains were offset by declines in China amid weaker out-of-home demand.

Foods underlying operating profit rose 2.7 per cent to €2.9 billion, with margin expanding 130 basis points to 22.6 per cent, reflecting gross margin improvement, overhead discipline and focused brand investment.

With a strengthened Foods strategy and improved profitability, Unilever enters 2026 focused on disciplined execution and sustained growth.

Technology

Barry Callebaut Opens Global Innovation Centre in Singapore

Feb 11, 2026 | Company News

Blueberries Built for Export, Consistency and Premium Programs

Feb 09, 2026 | Food

Australia Approves Commercial Release of GM Purple Tomato

Feb 06, 2026 | Australia

Food Testing

AFNOR International Eyes Global Food Safety Growth with HACCP Group Takeover

Feb 04, 2026 | Australia

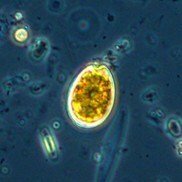

Incheon National University researchers uncover hidden toxin risks during nutrient-starved algal blooms

Feb 02, 2026 | Food Safety and Testing

How audit-led approaches are reinforcing trust in retail food safety

Feb 02, 2026 | Food Safety and Testing

More Popular

JBS to Establish Middle East’s Largest Regional Investment in Oman

Feb 12, 2026 | Company News

Unilever Reports Resilient 2025 Performance; Foods Business Delivers Steady Growth

Feb 12, 2026 | Company News

Heineken Delivers Resilient 2025 Performance, Launches EverGreen 2030

Feb 12, 2026 | Beverages