Saturday, 7 March 2026

Treasury Wine Estates announces acquisition of DAOU Vineyards

Acquisition generates significant value creation opportunity, building on Treasury Wine Estates’ and DAOU’s unique strengths to curate a combined luxury portfolio with worldwide expansion potential through Treasury Wine Estates’ global…

Acquisition generates significant value creation opportunity, building on Treasury Wine Estates’ and DAOU’s unique strengths to curate a combined luxury portfolio with worldwide expansion potential through Treasury Wine Estates’ global distribution network and consumer expertise

Treasury Wine Estates Ltd one of the world’s leading wine companies announced that it has reached an agreement to acquire DAOU Vineyards, the acclaimed luxury wine business founded by brothers and co-proprietors Georges and Daniel Daou for an upfront consideration of $900 million, plus an additional earn-out of up to $100 million. This transformative deal will accelerate TWE’s focus on a portfolio that is increasingly luxury-led with a greater presence in key growth markets such as the U.S.

Founded in 2007 and based in the U.S. winemaking region of Paso Robles, California, DAOU has been the fastest-growing luxury wine brand in the U.S. trade over the past year and is recognised throughout the industry for its award-winning Cabernet Sauvignon-based PATRIMONY wines, unique consumer profile, and benchmark-setting luxury experiences. DAOU’s fully integrated digital platform, DAOU+, combines e-commerce and membership with seamless and unique features that increase consumer loyalty.

DAOU is a strong complement to TWE’s existing portfolio in upper-luxury price points and fills a key portfolio opportunity for Treasury Americas in the $20-40 range, as well as strengthens its luxury portfolio in the $40+ range. Utilising TWE’s global marketing and distribution expertise, the company’s long-term vision is to bring the exceptional DAOU portfolio, winemaking philosophy and unique luxury consumer experiences to new international markets. TWE will also explore sourcing opportunities outside the U.S. for DAOU, as part of its global sourcing strategy.

Technology

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News

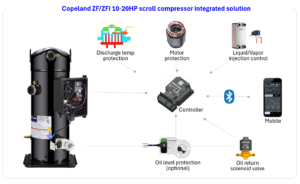

Copeland Launches ZF/ZFI 10-20HP Scroll Compressors

Mar 05, 2026 | Company News

Food Testing

NSF and Circle H Collaborate to Enable Global Certification Access

Mar 04, 2026 | Company News

Australian Medical Bodies Push for Compulsory Health Star Labelling

Feb 24, 2026 | Australia

Tim Hortons Singapore Secures Majlis Ugama Islam Singapura Halal Certification Ahead of Ramadan

Feb 23, 2026 | Company News

More Popular

Nutrition Education Drives Adoption of Seaweed and Mussels among Bangladesh Coastal Communities

Mar 06, 2026 | Food Security

Sidel introduces SWING Evo Pasteuriser, Redefines Efficiency through Intelligent Design

Mar 06, 2026 | Company News