Saturday, 7 February 2026

Israel’s FLORA Ventures launches $80M fund to invest in AgriFood start-ups

Innovative investment model partners with Kibbutzim to prototype and test emerging technologies to scale globally FLORA Ventures announces the launch of its $80 million fund, and its first closing with commitments of $50 million,…

Innovative investment model partners with Kibbutzim to prototype and test emerging technologies to scale globally

FLORA Ventures announces the launch of its $80 million fund, and its first closing with commitments of $50 million, making it the largest Israeli-based AgriFood VC. And, according to IVC data, it is the largest Israeli new VC fund to have completed a first closing during 2023 across all tech investment verticals.

FLORA Ventures invests in early-stage start-ups from two of the leading AgriFood ecosystems, Israel and Europe, that are building a healthier, more sustainable and resilient AgriFood system; and supports those ventures in scaling globally.

The fund’s model is unique in that it is the first VC fund to tap the world’s ‘original’ innovative agriculture pioneers – the Israeli Kibbutzim – as anchor investors and partners.

FLORA Ventures co-founders are Gil Horsky, former Mondelēz executive, corporate venture investor, and leading figure in the global AgriFood ecosystem, and Esther Barak-Landes, renowned VC investor and co-founder of Nielsen’s incubator and investment arm. They secured funding in just four months by identifying an opportunity to fill technology gaps such as food security, digitisation, sustainable agriculture, and food as medicine.

They completed the initial raise with top-tier strategic partners including Sadot Kibbutzim, a co-op bringing together more than 185 Kibbutzim with an agricultural output of +$3B exported to over 100 countries. They offer the fund’s portfolio proprietary access to agricultural land, production capabilities and expertise for initial proof of concept and the ability to scale their technologies.

Gil Horsky and Esther Barak-Landes say the infliction point of COVID-19, the Ukraine war and the climate crisis underscored the urgency for a fund like FLORA Ventures to accelerate innovation and impact in the $8T AgriFood industry.

Technology

Australia Approves Commercial Release of GM Purple Tomato

Feb 06, 2026 | Australia

Detmold Group Reports Progress on Emissions Reduction, Circular Packaging Goals

Feb 05, 2026 | Australia

FAO on Balancing Climate Urgency and Food Safety in Emerging Agrifood Technologies

Feb 05, 2026 | Food Security

Food Testing

AFNOR International Eyes Global Food Safety Growth with HACCP Group Takeover

Feb 04, 2026 | Australia

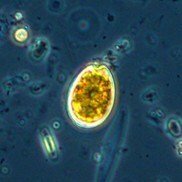

Incheon National University researchers uncover hidden toxin risks during nutrient-starved algal blooms

Feb 02, 2026 | Food Safety and Testing

How audit-led approaches are reinforcing trust in retail food safety

Feb 02, 2026 | Food Safety and Testing

More Popular

Fertility Meets Farm-to-Table Dining with Launch of ‘The Fertility Table’ in India

Feb 06, 2026 | Company News

Australia Approves Commercial Release of GM Purple Tomato

Feb 06, 2026 | Australia

Alternative Proteins Could Add €111 Billion Annually to EU Economy by 2040, Study Finds

Feb 06, 2026 | Europe